Start Up

Start Up

PROMOTIONS

1-Year Commercial Registered Agent Services* with a Business Start-up package.

*first year

Expires 3/31/23

FreePROMO CODE: CRA23

MORE DETAILS

- Business Start-up Documents

- Formation Minutes

- Operating Agreement

- Consultations

Expires 3/31/23

$99.00PROMO CODE: BDC23

MORE DETAILSBUSINESS START-UP COMPLETE PACKAGE $2,500

-

Filing with Nevada Secretary of State

-

Business Entity

-

List of Officers

-

Filing Acknowledgement

-

Certificate of Good Standing

-

Operating Agreement

-

Minutes of the Meetings

-

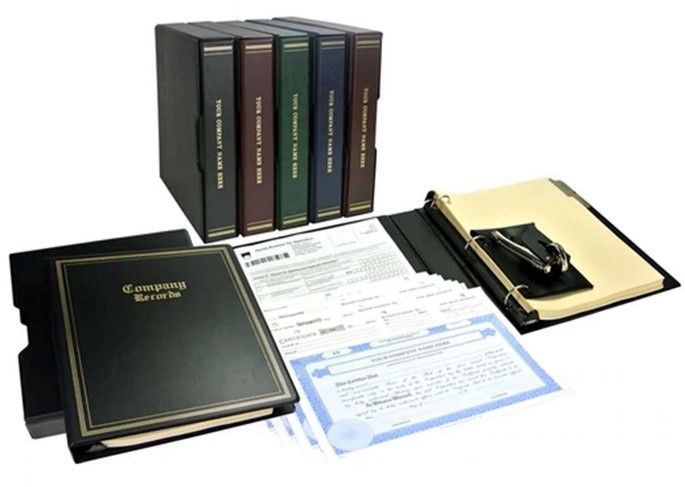

Custom Corporate Kit & Seal

-

EIN (Identification Number)

-

Business Consultations

-

1 Year Commercial Registered Agent Services

- PROMO CODE: BSP25

.webp)

Business Asset Protection Consultation $250

-

Review of Corporate Structure

-

Search for Compliance Issues

-

Applicable Protection Strategy Suggestions

PROMO CODE: BAP25

Start your new LLC or S-Corp for Asset Protection & Tax Advantages!

COMPANY

COMPANY

LET'S GET STARTED BY CHOOSING YOUR COMPANY'S NAME

AVAILABILITY

Don’t get “married” to a name until you’ve researched that it’s available. The domain may be taken, but it may not be registered. We will help with solutions to that problem.

REFLECT WHAT YOUR COMPANY DOES

Be distinctive and don’t confuse your company with a competitor or other company. Keep it concise, short and easy to spell. Think about how it looks and sounds. Sketch out a logo and come up with name abbreviations (how will your email address look?).

MAKE IT MEMORABLE

Keep a positive connotation and make it catchy. An image / visual element is very important. Be unique! What is your tag line going to be? Do you need a jingle? What makes your business stand out?

STRATEGY AND IMPLEMENTATION

We will check availability of your name choices, the pros and cons and alternative names/suggestions. We make this process fun… and most importantly, we help you protect the name immediately!

COMMERCIAL REGISTERED AGENT SERVICES

COMMERCIAL REGISTERED AGENT SERVICES

All businesses incorporated in the state of Nevada, or doing business in the state of Nevada as a foreign corporation or LLC, must have a Registered Agent. The required Registered Agent must be located within the state and open during normal business hours to accept service of process on the corporation’s or LLC’s behalf.

Having a Resident Agent keeps you in compliance and good standing with the Nevada revised statutes. Without maintaining this compliance, your corporate structure and asset protection plans may not hold up as a “veil” between your business and your personal assets in the event of a lawsuit.

If you are a foreign corporation and do not have an office in Nevada, our Commercial Registered Agent service will keep you in compliance with Nevada laws. If you are a business owner in Nevada, but work from home, you can utilize our services to stay in compliance.

Maintaining proper compliance is an absolute necessity whether in state or out of state. If you’re not in compliance, and your corporation goes into default or revoked status, you will be treated the same as if you had no corporation or LLC if you were to get sued; this default or revoked status also applies for tax purposes.

The penalties for late filing are severe. They are 50% of any outstanding fees owed.

COMMERCIAL REGISTERED AGENT KEY POINTS

COMMERCIAL REGISTERED AGENT KEY POINTS

Business consultations on compliance issues

Annual statutory compliance with the Nevada Secretary of State

Timely notices of all corporate filings due and any changes in the law that may affect your business

BUSINESS ENTITIES

BUSINESS ENTITIES

We provide comprehensive programs to meet all of your business needs and ensure compliance with all rules and regulations required by law.

In deciding which business structure is best for your individual circumstance, it is wise to consider all possibilities. However, NEVER set up your business as a Sole Proprietorship! You do not have the same tax advantages as a corporation. All of your assets, both business and personal, are at risk. Without legal separation, you will never get a true business loan. Corporate structuring establishes a new business with the proper entitie(s) designed for maximum asset protection for the owners, investors and shareholders.

We set up businesses correctly to provide proper protection, privacy and tax advantages. We can take an existing business, restructure it to protect assets and maximize tax advantages. Proper corporate structuring is like a foundation to a building.

The better the foundation, the stronger the building, the longer it will last and the best way to protect it.